E.M.B.R.A.C.E. Grant

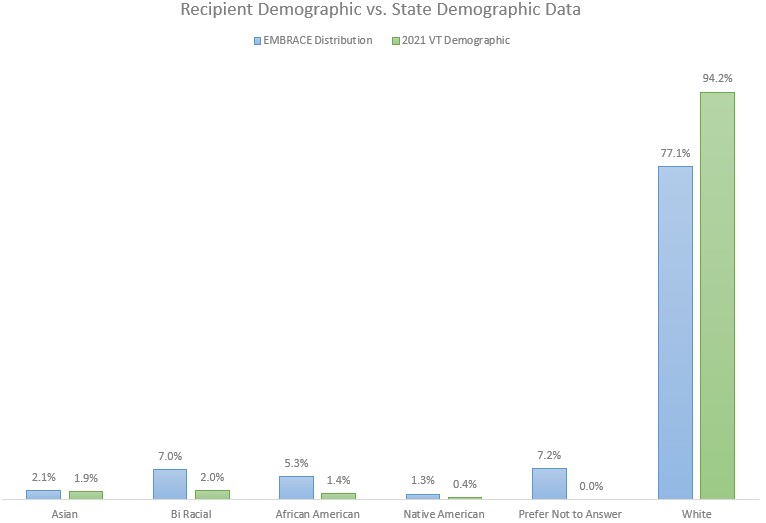

In response to COVID-19, the Vermont Community Action Partnership and the Micro Business Development Program(MBDP) came together to establish the E.M.B.R.A.C.E. (Economic Micro Business Recovery Assistance for the COVID-19 Epidemic) direct grant program. Thank goodness for the acronym! The E.M.B.R.A.C.E. Grant project was designed to assist underserved Vermont micro business owners that were financially impacted by COVID-19. The program provided grants of $5,000 to qualifying micro business owners. This grant provided greater household financial security and aimed to help retain, expand, and start micro businesses.

The businesses that received E.M.B.R.A.C.E. Grant funding are those that belong to underserved communities. We aimed to educate applicants in need of assistance by referring them to their local MBDP Business Counselor if the need for education on business principles was identified.

*This grant has expended all the allocated funds and is no longer available. This page represents the success of the initiative.

This grant was extremely helpful to my business during a time of economic hardship. It allowed us to remain

in operation, and even expand some of our offerings! Thank you so much for making this possible.

– Phoebe Tucker (Renegade Apothecary, LLC)

Total Amount of Funding Distributed

$2,355,000

Total Number of Businesses Funded

471

Number of New Business Start Ups

94

Average Household Income

$28,281.37

Businesses Registered as a Sole Proprietorship or Single Member LLC

91%

Percentage of Women Owned Businesses

61%

Team E.M.B.R.A.C.E. should get an award, and share the strategies and protocols that enabled them to get this grant into our business accounts as fluidly as they did, under the extreme duress of all the confusion and upheaval of COVID-19 lockdown. It was heroic. For many people, this grant might not SEEM like a lot of money -- but for so many of us as self-employed and part of the plethora of microbusinesses that keep Vermont the Vermont we know and love, this was a lifeline like air and water. - Rev. Claire Longtin North (A Community Ministry in the Mountains)

“The Grant came at just the right time and helped me grow my business. I did not have the money to invest in the equipment I purchased.

I would not have been able to grow my business without the grant. I am so grateful for it.” – Shannon Bates (Enna, LLC)

“I'm grateful for the support, it made a difference in a moment where it really mattered. Thanks!” – Justin Lander (Modern Times Theater, LLC)